Your Work Has Value. We Make Sure You Get Paid for It.

Each year, employers illegally withhold billions of dollars in earned wages from employees. This is wage theft. It happens in many ways. Unpaid overtime and illegal deductions are common examples. The result is always the same – you are not paid the money you are legally owed.

Stop Wage Theft Lawyers have one mission. We recover unpaid wages for workers like you. We are a national law firm. We represent employees in all 50 states. We hold companies accountable under the Fair Labor Standards Act (FLSA) and state wage laws. Our attorneys know the tactics employers use to avoid paying proper wages. We have the resources to fight for your rights in complex class-action lawsuits.

You do not have to fight this fight alone. We offer a free and confidential consultation to help you understand your rights.

Past and Recent Results

Industries We Represent

Some of the representative Stop Wage Theft Lawyers back pay recoveries for employees in various industries include:

Restaurant Industry

Delivery Drivers/Route Salesmen

Timeshare Industry

Service Industry

Grocery Industry

Manufacturing Industry

Insurance Industry

Real Estate Industry

Health Care Industry

Free Confidential Consultation

The Stop Wage Theft Lawyers Advantage

- A Proven National Track Record

We have successfully recovered over half a billion dollars for employees and consumers across the United States. Our results in high-stakes, multi-state class-action lawsuits show our success. - Deep Federal & State Law Expertise

Other firms focus purely on local laws. Our practice is built on a deep knowledge of the federal Fair Labor Standards Act (FLSA) and similar state laws. The FLSA protects most workers in the U.S. This focus gives our clients a distinct advantage. - No Upfront Costs. No Fee Unless We Win.

Justice should not depend on your ability to pay. Our firm works on a contingency-fee basis. We only get paid if we successfully recover money on your behalf.

Recovered

Cases Won

Lawsuits

Lawyers

Common Ways Employers Violate Federal Wage Laws

Wage theft is not always obvious. You might have a claim to recover back pay if these situations seem familiar. In many cases, you could receive double that amount in liquidated damages.

“OFF-THE-CLOCK” WORK

One of the most common violations of federal and state wage laws occurs when employees perform work that is unpaid or which isn’t counted toward overtime because it is not captured in the company’s time keeping system.

"SHAVING" HOURS

Another common violation occurs when employers intentionally underreport work time, such as when a supervisor “shaves” employee work hours from the computer system…

BREAK TIME VIOLATIONS

Federal law does not require that employers provide their employees meal or rest breaks, though many state and local laws do.

MISCALCULATING OVERTIME PAY

The overtime pay standard in §7(a) of the Fair Labor Standards Act requires that overtime must be compensated at a rate not less than one and one-half times the regular rate.

MISCLASSIFYING EMPLOYEES AS EXEMPT FROM OVERTIME

Certain categories of employees are “exempt” from overtime pay under the Fair Labor Standards Act, as well as under most state laws.

Read More

DEDUCTIONS FROM SALARIED-EXEMPT EMPLOYEES

The Department of Labor’s regulations related to “white collar” exemptions state that an employee is paid on a “salary basis” if the employee regularly receives each pay period,

Read More

TIPPED WAGES VIOLATIONS

Read More

“ROLLING” OVERTIME HOURS AND “COMP TIME”

Read More

PAYING “STRAIGHT-TIME” FOR OVERTIME HOURS

Read More

IMPROPER ROUNDING OF HOURS WORKED

Read More

WORK FROM HOME

Read More

TRAVEL TIME

Read More

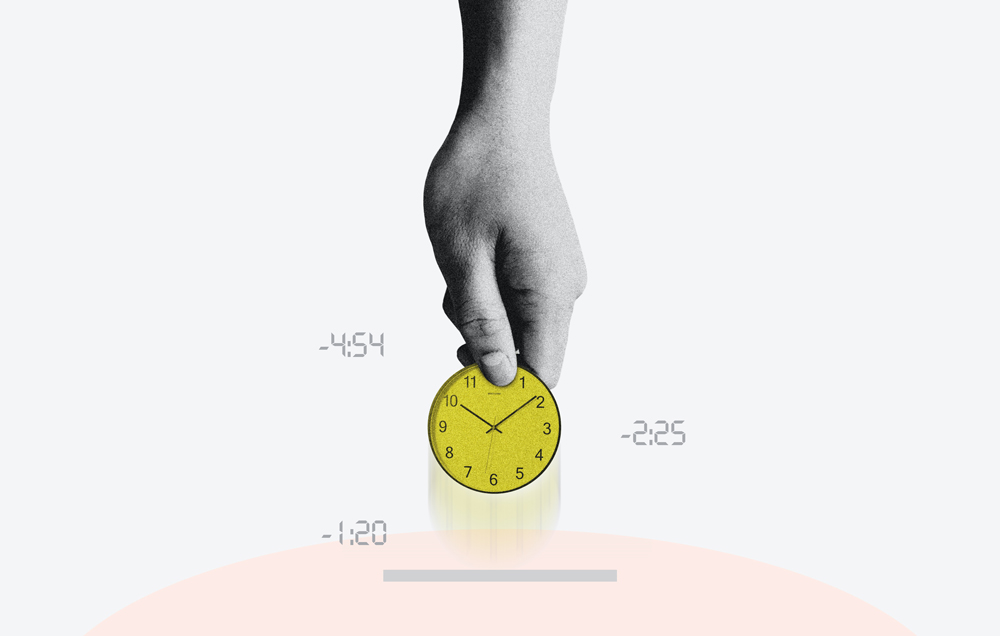

Do Not Wait to Claim the Wages You Earned

Federal & State law puts strict time limits on your ability to recover unpaid wages. Each day you wait potentially reduces the amount of money you can claim.

Take the first step today. Contact our team for a 100% free and confidential review of your case. We will listen to your story. We will answer your questions. We will give you a clear assessment of your legal options.